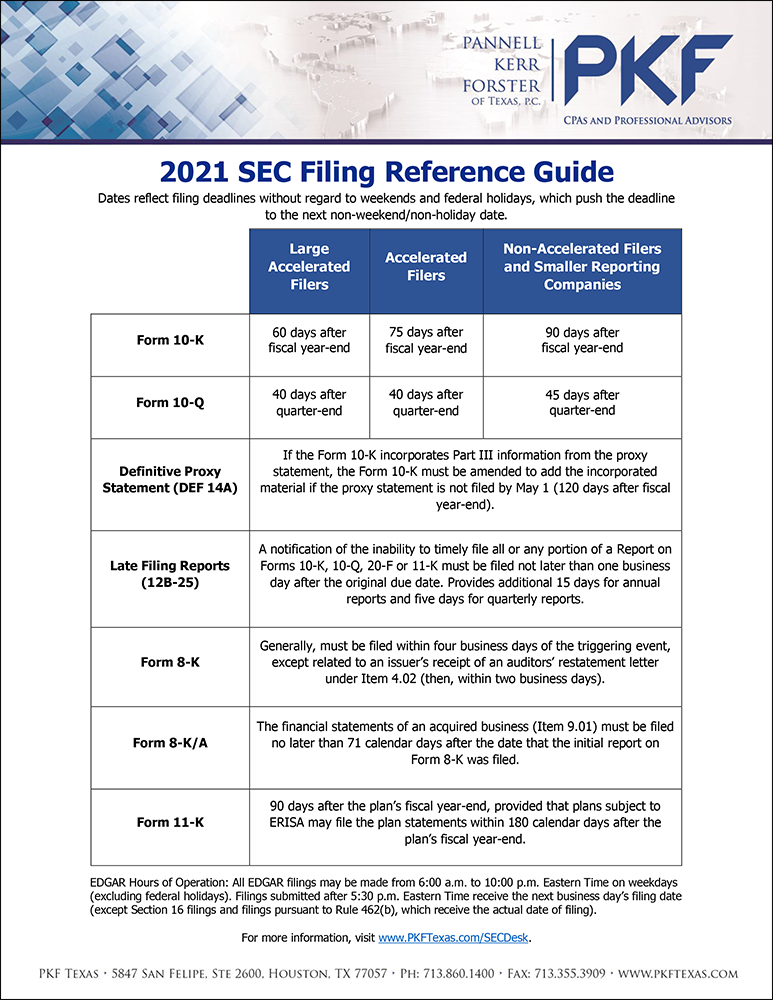

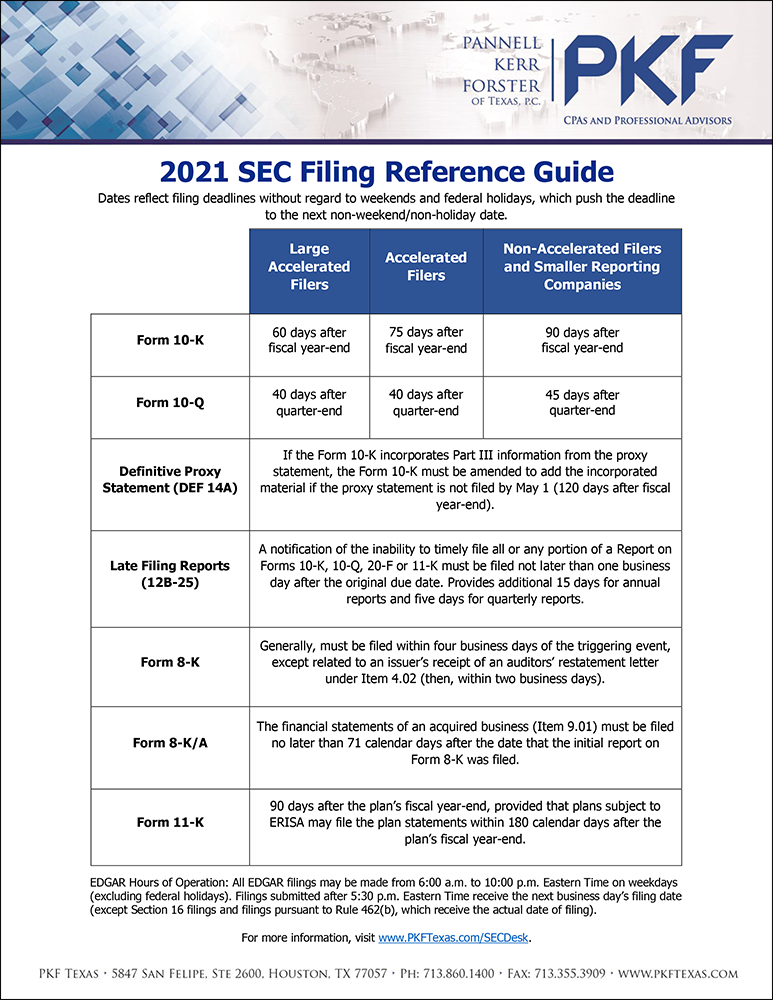

We have updated our website's SEC Desk with the 2021 SEC Filing Reference Guide, which...

The 2021 SEC Filing Reference Guide is Available!

read more

We have updated our website's SEC Desk with the 2021 SEC Filing Reference Guide, which...

According to a Sept. 26, 2019 press release, the Securities and Exchange Commission...

As part of its Disclosure Effectiveness Initiative of the Division of Corporation...

The U.S. Securities and Exchange Commission ("SEC") voted last week to adopt amendments...

Please fill out the form below and we will contact you to set up a meeting or call with a PKF Texas team member.