The Consolidated Appropriations Act signed at the end of 2020 changed the eligibility...

The Consolidated Appropriations Act signed at the end of 2020 changed the eligibility...

The IRS released new ruling and guidance on November 18, 2020 for businesses who...

If your business was fortunate enough to get a Paycheck Protection Program (PPP) loan...

The Small Business Administration (SBA) and Department of Treasury released an updated...

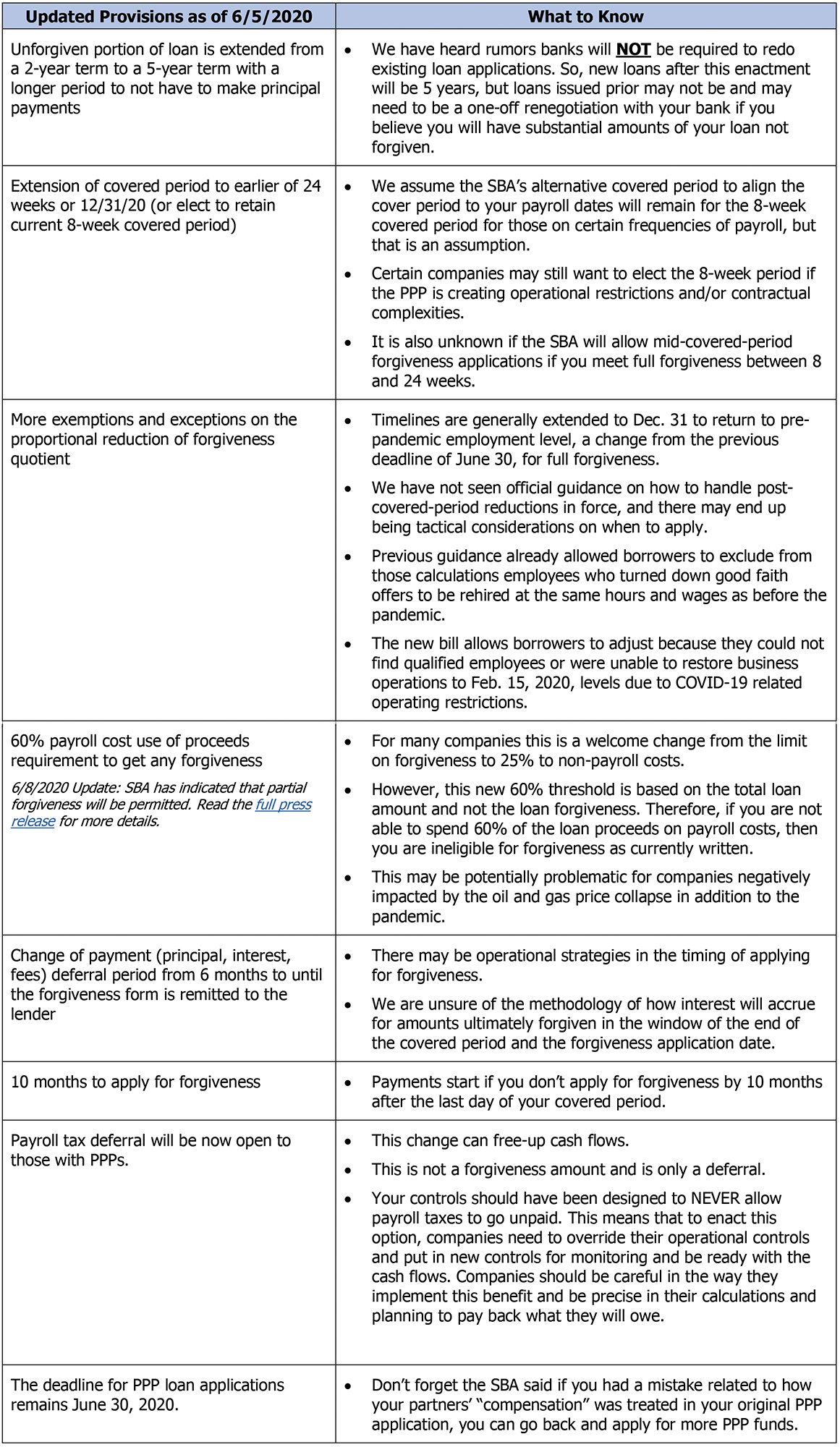

The Paycheck Protection Program (PPP) Flexibility Act amends the Small Business Act and...

Disclaimers: The Small Business Administration and...

The Small Business Administration (SBA) and Department of Treasury released the Paycheck...

On Thursday, April 30, 2020, the IRS released Notice 2020-32. Specifically, “this notice...

On Friday, April 10th, the IRS released an FAQ for Deferral of Employment Tax Deposits...

On March 27, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed...

Please fill out the form below and we will contact you to set up a meeting or call with a PKF Texas team member.