Jen: This is the PKF Texas Entrepreneur’s Playbook. I'm Jen...

coronavirus

read more

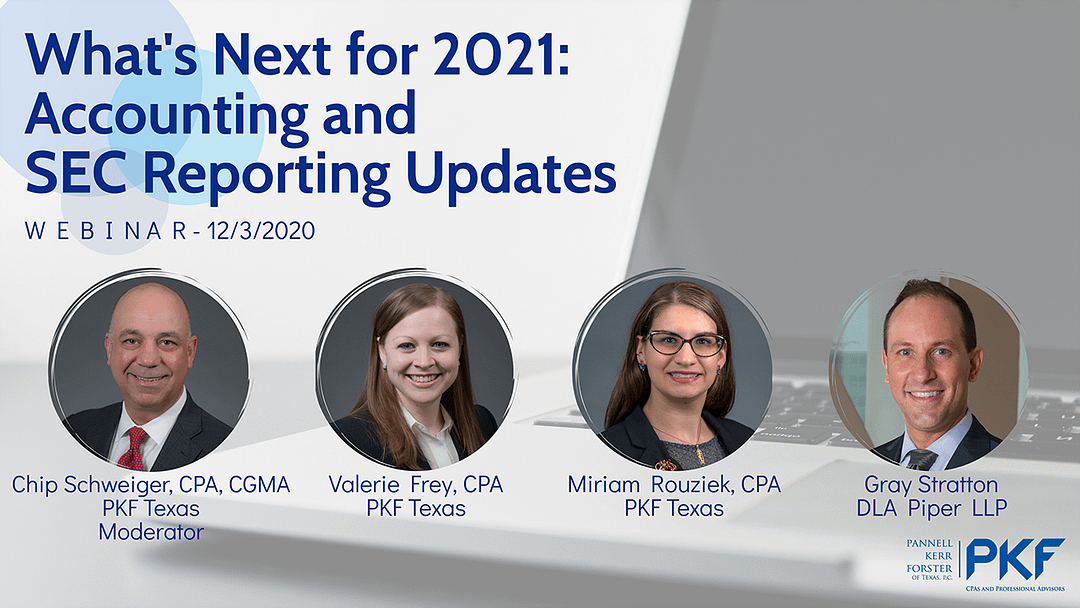

Recap: Accounting and SEC Reporting Update Zoom Webinar

Deemed as a riveting presentation from a CFO and SEC registrant attendee, PKF Texas...

How New PPP Loan Guidance Impacts Tax Planning

The IRS released new ruling and guidance on November 18, 2020 for businesses who...

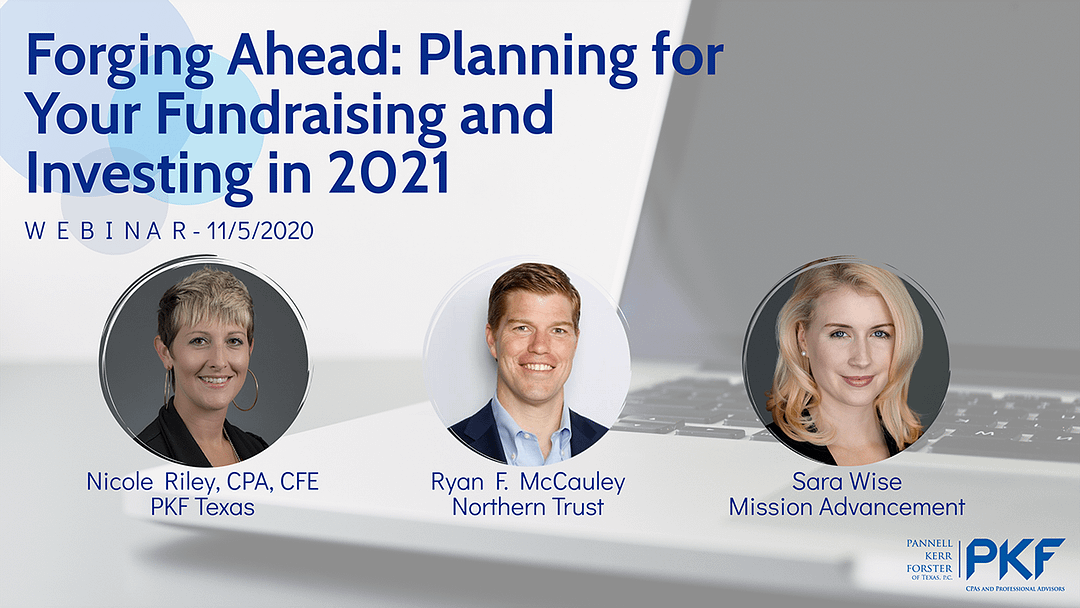

Recap: Planning Your 2021 Fundraising and Investment Zoom Webinar

The PKF Texas not-for-profit team hosted its next Zoom webinar, “Forging Ahead: Planning...

The Tax Responsibilities of Your Business Closing

Is your business closing? Unfortunately, the COVID-19 pandemic has forced many to shut...

Free Webinar Event: “State of Giving” Panel

The city of Houston is known for being a giving city, but how has the COVID-19 pandemic...

How to Help Ease Your Not-for-Profit’s Staffers’ Anxiety

It would be an understatement to say 2020 has been challenging. Leaders of...

Keep Tax Records or Throw Them Away?

If you’re finally done filing last year’s return, you might wonder: Which tax records...

A Licensing Arrangement as a New Revenue Source

In this pandemic year, many not-for-profits are scrambling to find new sources of...

If You’re Working from Home or Collecting Unemployment…

COVID-19 has changed our lives in many ways, and some of the changes have tax...